Introduction

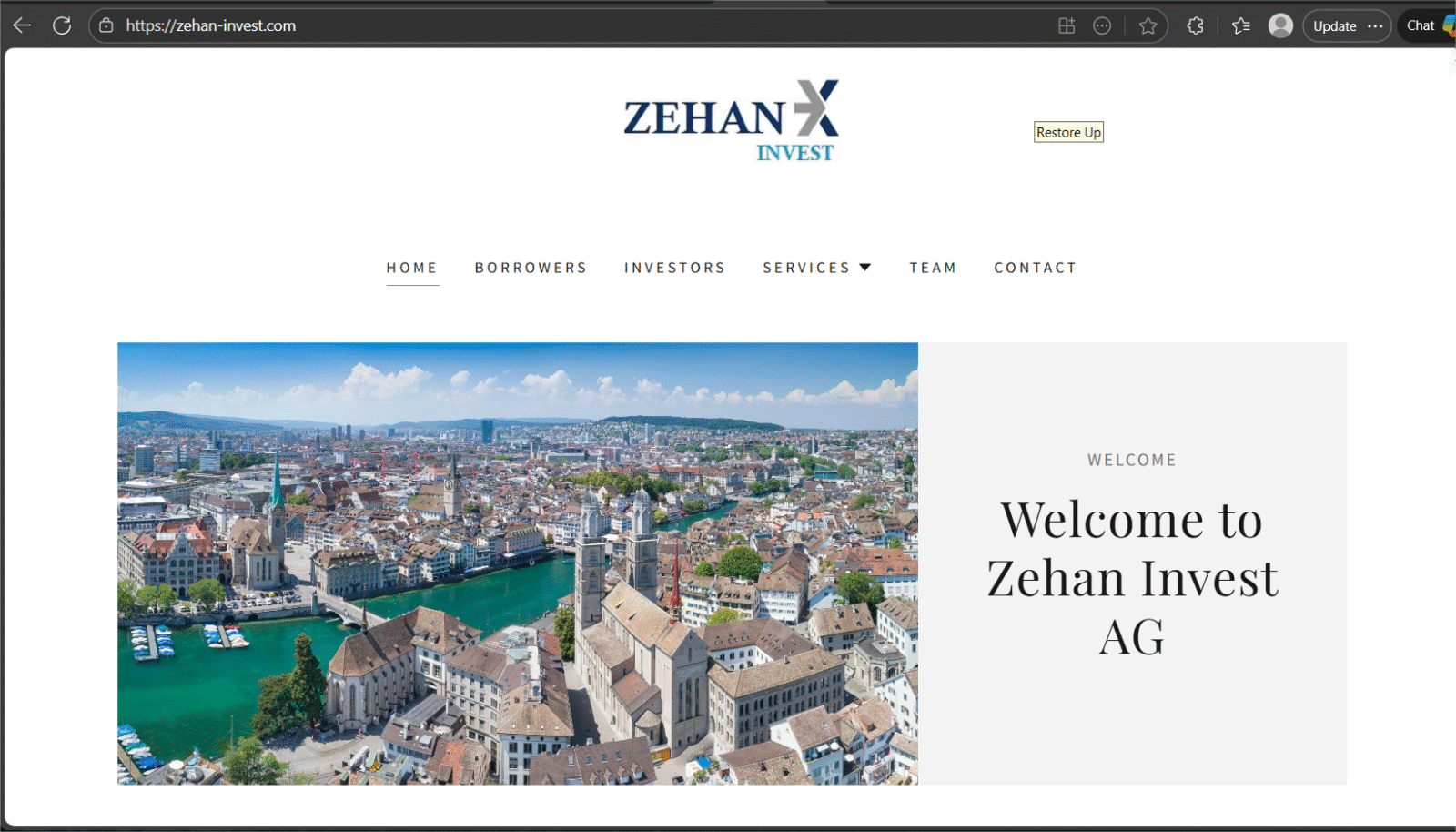

In the digital age, many investment platforms claim to offer new paths to financial growth—especially in emerging sectors such as direct lending, real estate, or middle-market financing. Among these, Zehan-Invest (operating under domains such as zehan-invest.com and zehan-invest.ch) presents itself as an asset manager or financial intermediary arranging capital for private companies. But closer inspection shows serious warning signs and regulatory red flags. In this article, we dissect Zehan-Invest’s claims, evaluate what is publicly verifiable, highlight inconsistencies, and caution prospective investors about the risks.

What Zehan-Invest Claims to Be

Zehan-Invest.com presents itself as:

- Asset manager / direct lender providing capital to middle-market companies

- Offering debt solutions across different debt tranches

- Serving firms with EBITDA between CHF 1 million and CHF 50 million

- Claiming to have deployed over CHF 250 million across more than 200 portfolio companies

- Promoting “cryptofinance solutions” and flexible debt instruments

- Operating in real estate investment alongside lending activities

These are ambitious claims that, if true, would require strong infrastructure, regulatory compliance, corporate transparency, and a verifiable track record.

Public Records & Verifiable Facts

Publicly accessible information shows:

- Regulatory Warning: Zehan-Invest.com is on the Swiss financial regulator’s warning list, indicating it is not registered and may be offering services without proper authorization.

- Company Registration: A company with a similar name exists in Switzerland, but the website’s claims about large-scale lending remain unverified.

- Business Category: Listings describe activity related to land subdivision or real estate, which differs from its bold claims of large-scale middle-market lending.

- Trust Ratings: Automated website-scanning services show mixed results—some note basic site security, while others score the domains as suspicious and untrustworthy.

These facts reveal both traces of legitimacy and significant red flags—requiring cautious interpretation.

Discrepancies, Red Flags & Inconsistencies

While Zehan-Invest.com presents itself as a capable lender/asset manager, there are troubling inconsistencies:

1. Regulatory Warning & Non-Registration

Being on a financial regulator’s warning list is a serious concern. It indicates that Zehan-Invest.com is not properly registered and may be engaging in financial activities without legal authorization. In Switzerland, firms providing financial services such as asset management or lending usually require official oversight.

2. Domain Anonymity & Low Transparency

- Domain registration details are hidden, reducing traceability.

- The site’s traffic is low for an operation claiming to manage hundreds of millions.

- Positive trust ratings from automated tools merely reflect technical factors like SSL encryption, not true business legitimacy.

3. Ambitious Claims Without Evidence

- Claims of funding CHF 250+ million across 200+ companies are substantial.

- Yet no third-party audits, financial statements, or independent performance reports are publicly available to confirm this.

4. Mixed Review Outcomes

- Some web tools rate the site as moderately safe, while others warn of a high risk of fraud.

- Domain age is relatively young—another classic red flag for scams.

5. Recent Regulatory Listing

- The warning listing is recent, suggesting active concern from regulators.

How a Scam of This Type Often Operates

While we cannot prove every internal detail, many fraudulent lending or investment schemes follow a familiar pattern:

- Initial Contact & Marketing

Aggressive outreach via ads or email promising high returns with low risk. - Onboarding & Small Deposit

Prospects are asked for a modest deposit to gain access to “lending opportunities” or “investment pools.” - Simulated Returns / Fake Dashboard

A trading or lending dashboard displays fabricated gains to entice larger investments. - Upsell for Bigger Capital

Operators invite investors to commit more funds for “premium” opportunities, often using pressure tactics. - Withdrawal Barriers

When a user requests withdrawal, new hurdles arise— “processing fees,” “verification taxes,” or endless delays. - Communication Shutdown

Eventually, operators stop responding and may shut down the site, often reappearing under a new name.

Where Zehan-Invest Fits This Pattern

Based on public evidence and the issues noted, Zehan-Invest.com shares multiple characteristics of high-risk operations:

- Listed on a regulator’s warning list

- Makes bold financial claims without independent verification

- Maintains hidden ownership and low transparency

- Relies on marketing language without audited data

Protective Steps for Potential Investors

If you’re evaluating Zehan-Invest.com—or any similar online investment platform—take these precautions:

- Verify Regulatory Status Independently

Check official financial regulator databases yourself. - Demand Audited Financials

Legitimate managers publish annual reports, portfolio summaries, and audited performance. - Test Withdrawal Early

Before committing significant funds, deposit a small amount and attempt a withdrawal. - Research the People Behind It

Look up managing directors, their credentials, and previous track records. - Use Payment Methods with Recourse

Prefer methods that allow chargebacks or dispute resolution. Avoid irreversible transfers. - Don’t Fall for Pressure

Fraudsters often push investors to hurry before an “exclusive opportunity” disappears. - Check External Reputation

Search independent forums and consumer watchdog sites for consistent user experiences.

Balanced Perspective

While being on a regulator’s warning list doesn’t automatically prove criminal intent, it is a significant caution sign. Automated trust ratings are also imperfect, but when combined with ambitious claims and a lack of verifiable transparency, the risk clearly outweighs any potential reward.

Conclusion: Extreme Caution Advised

Zehan-Invest promotes itself as a serious direct lender and asset manager, claiming extensive funding of middle-market companies and structured debt products. Yet public records paint a troubling picture:

- It is flagged by a major Swiss regulator.

- Domain ownership is opaque and trust scores are mixed.

- Ambitious financial claims lack independent verification.

In online finance, legitimacy is not earned by slick marketing or impressive claims. True trust is built through transparency, independent oversight, and verifiable accountability.

Report Zehan-Invest.com and Recover Your Funds

If you have fallen victim to Zehan-Invest.com and lost money, it is crucial to take immediate action. We recommend Report the scam to WEALTH TRACKER LTD, a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Zehan-Invest.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception. WEALTH TRACKER LTD, a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Leave a comment