Introduction

Introduction

When Vertex Trading launched, it promised to bridge a gap many crypto investors worried about — security. The company positioned itself as an “institutional-grade custodian for retail clients,” assuring users their funds would be protected under insured cold storage and rigorous compliance standards.

The message resonated deeply. For thousands of cautious investors burned by exchange hacks and DeFi collapses, Vertex Trading looked like the ideal compromise — professional custody without Wall Street bureaucracy.

Its website boasted of “multi-signature security layers,” “insured vaults,” and “24/7 risk monitoring.” Every sentence seemed designed to reassure. The reality, however, was a nightmare: behind the gloss was a sophisticated phantom custodian that siphoned millions from investors before disappearing into the blockchain shadows.

Red Flags

Even at the height of its popularity, Vertex Trading exhibited several signs that, in retrospect, screamed danger. Understanding these helps investors identify similar traps in the future.

-

Unverifiable Insurance Claims

The platform flaunted “$250 million in cold-storage insurance coverage underwritten by Global Fidelity.” But no record of that underwriter existed, and none of the alleged insurers confirmed affiliation. Always confirm insurance directly with the provider — not through the platform’s PDFs. -

False Custody Language

The company described “multi-signature wallet storage” but asked users to “temporarily transfer full access rights for verification.” Real custodians never ask for private keys, mnemonic phrases, or unrestricted control. -

No Proof-of-Reserve Disclosures

Despite claiming “independent audits,” there was never a verifiable proof-of-reserve report. Legitimate custodians publish these publicly or allow third-party verification through blockchain explorers. -

Anonymous Leadership

The supposed “Chief Risk Officer,” “Audit Lead,” and “Operations Director” had LinkedIn profiles that were recently created, with no prior work history or endorsements. -

Overly Polished Marketing

Everything — the brochures, explainer videos, and “security whitepaper” — looked hyper-professional but offered zero technical detail. It was corporate theater meant to lull users into comfort. -

Complex Withdrawal Procedures

Withdrawals were delayed under the pretext of “anti-money laundering (AML) verification.” Later, users were told to pay an “insurance premium renewal” before funds could be released. -

Silent Compliance Section

The website mentioned partnerships with regulators and banks but never named any. Once complaints mounted, those references were quietly deleted.

Each red flag reflected a fundamental pattern — overpromising safety to justify total control over users’ assets.

Fake Branding & False Legitimacy

Vertex Trading’s success hinged on false legitimacy. It exploited the credibility of the word custodian — a term associated with banks, auditors, and regulated financial institutions.

1. The Illusion of Institutional Ties

The site featured the logos of genuine custodial giants like Fireblocks, Gemini Trust, and BitGo, implying partnerships. Inquiries to those firms revealed no affiliation.

2. The “Security Whitepaper”

A downloadable PDF with intricate diagrams and cryptographic terms appeared to describe a genuine custody process. But cybersecurity experts who later reviewed it noted that it was plagiarized from open-source documentation on GitHub.

3. The KYC Trap

Vertex Trading required investors to upload sensitive personal data “for security compliance.” Many victims later discovered their IDs circulating on black-market identity forums — meaning the scam also functioned as a data-harvesting operation.

4. The Regulatory Mirage

The company claimed registration in Switzerland and the British Virgin Islands under license #VT-3471-CC. Neither jurisdiction listed any such entity in their financial databases.

5. The “Audit Seal” Deception

Fake seals from Deloitte and KPMG appeared in the footer of the site. Both firms issued public statements clarifying they had never conducted an audit for Vertex Trading.

Everything was constructed to feel legitimate enough for due diligence to fail. Even sophisticated investors were fooled because every check led to a surface-level confirmation — a hallmark of social engineering at scale.

Victim Story (Realistic + Emotional)

Hassan, a 38-year-old import business owner in Dubai, had built modest crypto savings over three years. Like many, he sought safer storage after exchange collapses eroded his trust. Vertex Trading’s website seemed to offer precisely what he needed: insured, compliant, professionally managed custody.

He deposited $25,000 — his entire Bitcoin portfolio — through what appeared to be a secure cold wallet address provided by the platform.

“They sent me a PDF insurance certificate with a serial number. It looked official. The support team even called me once to walk me through ‘security protocols.’ It felt real.”

For months, Hassan received monthly “account summaries” showing small yield increments from “institutional lending.” But when he tried to withdraw $5,000 to pay suppliers, he was told his account was “temporarily under review due to irregular transaction patterns.”

After weeks of silence, he received a new message: “Please remit a 0.5% insurance renewal fee to process your withdrawal.” He complied, sending another $125.

Days later, the platform went offline. Emails bounced. Support chat vanished. Hassan’s funds were gone — along with his trust.

“They weren’t just thieves,” he recalls bitterly. “They were actors pretending to protect me.”

Psychological Manipulation Angle

The genius of Vertex Trading wasn’t technical — it was psychological. The scam weaponized the language of safety against the very people seeking it.

-

Security Theater

By bombarding users with jargon like cold storage, institutional custody, proof-of-insurance, and ISO 27001 compliance, the scammers created an aura of professionalism that discouraged skepticism. -

Authority and Trust Bias

Fake endorsements from real companies, mock legal disclaimers, and official-sounding job titles triggered subconscious associations with reliability. -

Fear of Risk

After years of exchange hacks and DeFi rug pulls, investors were primed to crave stability. Vertex Trading offered exactly what people wanted to hear — “no exposure, full insurance, zero volatility.” -

Scarcity and Urgency

Limited-time “institutional access” programs pushed users to deposit quickly. Investors were told that new spots opened “only once per quarter.” -

Personal Touchpoints

Phone-based “account managers” built rapport with investors, using friendly professionalism to disarm doubts. Once deposits were made, those same voices vanished.

This manipulation formula blended emotional safety and professional imitation, turning cautious investors into compliant victims.

Detailed Scam Breakdown (Step-by-Step Model)

-

Target Identification

Ads were aimed at cautious mid-tier investors — people burned by volatile markets but still optimistic about crypto’s potential. -

Lead Conversion

Email funnels and webinars promoted the concept of “insured custody.” Every contact was directed to a personal “custody advisor.” -

Onboarding & KYC

Victims were asked for identification documents to create the illusion of compliance. This also helped the scammers harvest usable identity data. -

Deposit Phase

Users transferred crypto to wallets “designated for cold storage.” These addresses led directly to exchanges controlled by the perpetrators. -

Reporting & Reinforcement

The platform generated professional account statements with line items like “storage verification” and “risk assessment,” further validating the illusion. -

Delay & Fee Stage

Withdrawals triggered verification delays and fake “insurance renewal fees.” Those who paid were re-trapped with additional requirements. -

Exit

Once the scam matured, wallet balances were drained. Domains were deleted or redirected to clone platforms with new branding.

This structured model mirrors the operational tactics used by other fake custody schemes like SafeFunds Capital and CryptoVault International.

Investor Awareness & Protective Measures

To guard against future schemes like Vertex Trading, investors must practice layered due diligence.

1. Verify Insurance Directly

Never take screenshots or PDFs at face value. Contact the insurer or reinsurer independently using publicly listed contact information.

2. Confirm Proof-of-Reserve

Reputable custodians offer public wallet visibility or verifiable third-party attestations. Demand it.

3. Keep Private Keys Private

No custodian should ever require private keys or full access for “speedy verification.” That’s immediate grounds for suspicion.

4. Cross-Check Corporate Registration

If the entity claims registration, verify it on official government business registries.

5. Avoid Non-Segregated Accounts

Reputable custodians maintain separate wallets for each client. Shared addresses indicate poor or fake management.

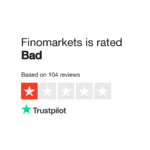

6. Check Reputation Across Communities

Reddit, Bitcointalk, and X (formerly Twitter) often flag new scams early. Search the project’s name plus “scam” before depositing.

7. Maintain Independent Backups

Keep transaction receipts, correspondence, and KYC confirmations in a secure offline archive for potential legal follow-up.

Recovery & Next Steps (Featuring WealthTracker Ltd)

For victims of Vertex Trading or similar custodial scams, quick, documented action can make a tangible difference.

Step 1: Evidence Preservation

-

Save every transaction hash, invoice, and email.

-

Export chat logs, statements, and the website URL (via archive.org if possible).

-

Identify deposit wallet addresses — crucial for blockchain tracing.

Step 2: Report to Authorities

File formal complaints with financial regulators or cybercrime units. Include all details, even if the company is offshore.

Step 3: Engage Professional Recovery Assistance

Organizations like WealthTracker Ltd specialize in blockchain forensic tracing and asset recovery. Their teams use advanced on-chain analytics to track stolen crypto through mixers and exchanges.

WealthTracker Ltd works by:

-

Mapping transactional flows across wallets and exchanges

-

Coordinating with compliance departments to freeze accounts tied to known scammers

-

Preparing detailed forensic reports for law enforcement or legal proceedings

Victims report that early collaboration with professionals like WealthTracker Ltd significantly improves recovery odds, especially when funds enter KYC’d exchanges.

Step 4: Protect Against Secondary Scams

Fraudulent “recovery agencies” often target victims twice. Avoid any firm demanding large upfront payments without legal credentials or case documentation.

Even if full reimbursement isn’t possible, prompt tracing and verified evidence can lead to partial recovery, prosecution of bad actors, or the freezing of laundered assets before they move beyond reach.

Conclusion

Vertex Trading represents a new class of crypto fraud — one that doesn’t promise moonshot profits but safety, stability, and professionalism. It proves that scams evolve with investor psychology.

Where past schemes sold greed, Vertex sold trust.

And that’s what makes it so dangerous.

True custody requires verifiable transparency, regulated oversight, and personal control over your digital assets. If a platform asks for full access, avoids audits, or hides behind buzzwords like insured custody, it’s not a protector — it’s a predator.

Introduction

Introduction

Leave a comment