Introduction

At first glance, Trade Defi appeared to be the future of intelligent investing. Its website showcased real-time charts, “AI learning algorithms,” and sleek dashboards that resembled genuine trading terminals. The promise was seductive — “AI-driven portfolio growth with guaranteed returns.”

For investors tired of volatile markets, Trade Defi’s pitch seemed like a golden ticket: effortless profits, automatic reinvestments, and instant withdrawals. Unfortunately, behind the façade of technology and sophistication lay a sophisticated fraud operation designed to drain wallets, exploit emotions, and vanish without a trace.

Red Flags

Red Flags

While Trade Defi’s presentation was immaculate, its operations exhibited classic scam signals that many missed in their excitement:

-

Guaranteed Returns:

The platform boldly promised “up to 5% daily ROI.” No legitimate trading firm guarantees fixed daily profits, especially in crypto. -

Unverifiable AI Claims:

There were no third-party audits, backtests, or public model documentation. The supposed “machine learning engine” was pure fiction. -

Anonymous Team Members:

The names listed on the “About Us” page led to nonexistent LinkedIn accounts or fake professionals with stock photos. -

Pressure to Compound:

Users were constantly urged to “let the AI reinvest profits” for higher-tier access — a psychological trick to prevent withdrawals. -

Withdrawal Barriers:

Requests were delayed with excuses like “liquidity lock,” “AML verification,” or “smart contract update,” effectively trapping investor funds. -

Fake Social Proof:

Influencers and paid actors posted fake “success stories” on YouTube and TikTok, creating a false sense of community trust.

Fake Branding & False Legitimacy

Trade Defi’s team knew how to appear professional. Their marketing strategy was textbook deception:

-

Visual Authority:

The site mirrored interfaces from real financial platforms — complete with trading graphs, API “data feeds,” and AI progress bars. -

Regulatory Disguise:

They displayed forged registration numbers and “European Financial Authority” seals that didn’t exist. -

Influencer Collusion:

Promotional videos featured supposed “crypto analysts” reviewing the platform — all paid to speak favorably without due diligence. -

Email Communication:

Victims received official-looking emails with headers like “TradeDefi Investor Relations” and links to fabricated audit reports hosted on free domains.

The illusion was complete: investors believed they were part of an exclusive AI hedge fund rather than a coordinated social-engineering operation.

Victim Story (Realistic + Emotional)

Marta, a 34-year-old freelance designer, stumbled upon Trade Defi through a sponsored video on YouTube. The video showed charts, testimonials, and an “AI quant developer” explaining how their bots “learned to outperform Bitcoin.”

Curious but cautious, Marta deposited $2,000. Within a week, her dashboard showed $6,400 — a 220% increase. Encouraged, she reinvested.

Three weeks later, she decided to withdraw $500 to test the system. Instead, she received an email from “Compliance” demanding a $200 liquidity release fee. She hesitated but paid — only for support to vanish overnight. The website later displayed “Server Maintenance,” and her funds disappeared.

Marta recalls the emotional devastation:

“I felt foolish. Everything looked real — the graphs, the dashboard, even the support team. I didn’t think I was gambling; I thought I was investing in technology.”

Her story mirrors hundreds of similar cases posted across crypto forums, each describing the same script: initial profit illusions, withdrawal hurdles, and ultimate loss.

Psychological Manipulation Angle

Scammers behind Trade Defi weaponized psychological triggers that manipulate both logic and emotion:

-

Authority Bias:

Pseudo-experts with fake LinkedIn credentials gave an impression of credibility. -

Fear of Missing Out (FOMO):

Marketing emails urged users to “lock in before the next AI update,” a tactic to rush deposits. -

Social Proof:

Bot-filled Telegram channels showed constant “profit notifications” and congratulatory messages from fake accounts. -

Commitment Bias:

Once investors saw apparent growth, they felt emotionally tied — “I’ve already made profits; I can’t back out now.” -

Reciprocity:

The platform initially allowed small successful withdrawals to build trust before closing off all exits.

These psychological levers transformed rational investors into emotional participants in a game they could never win.

Detailed Scam Breakdown (Step-by-Step Model)

-

Attraction Phase:

Trade Defi targeted users through paid crypto influencers, Reddit posts, and YouTube ads promoting “AI-powered passive income.” -

Engagement:

Once on the site, users interacted with sleek demo dashboards showing simulated profits and interactive bots posing as support agents. -

Deposit Funnel:

Investors were encouraged to start small — $100–$500 — through crypto deposits (usually USDT or BTC). The dashboard updated instantly, reflecting fake growth. -

Profit Simulation:

The “AI engine” generated random yet plausible profit margins daily. Some early users even received small withdrawals to enhance credibility. -

Reinvestment Push:

Support “advisors” urged reinvestment for higher ROI tiers, citing “model upgrades” and “compound bonuses.” -

Withdrawal Resistance:

As users attempted withdrawals, excuses multiplied — liquidity issues, verification errors, or “smart contract locks.” -

Exit Strategy:

Once enough deposits accumulated, the site went offline under the pretext of “system maintenance,” then reappeared under a new domain using similar design templates.

Trade Defi’s operation was a carbon copy of prior Ponzi-style “AI” schemes — professional, manipulative, and nearly impossible to trace without expert help.

Investor Awareness & Protective Measures

If you encounter platforms promising AI trading profits, use this five-step verification framework:

-

Verify Company Registration:

Check regulatory databases (FCA, ASIC, SEC, etc.) for licensing. Scams often use fabricated registration numbers. -

Search for Third-Party Audits:

Legitimate AI trading models undergo independent testing and transparency reviews. -

Perform Reverse Image Searches:

Use Google Lens to confirm if “team member photos” are stolen stock images. -

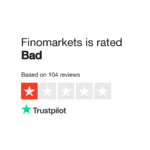

Check Community Reviews:

Visit forums like Reddit, Trustpilot, and Bitcointalk for real user experiences. -

Test Withdrawals Immediately:

If even small withdrawals stall or demand extra fees, exit immediately and report the issue.

Awareness doesn’t just protect your funds — it helps dismantle the social engineering webs that sustain these scams.

Recovery & Next Steps (Featuring WealthTracker Ltd)

Victims of Trade Defi or similar AI-trading scams still have hope for recovery — but time is critical.

The first step is evidence preservation:

-

Save wallet addresses, transaction IDs, and emails.

-

Screenshot dashboard data before the website disappears.

-

Record all communication logs.

Next, engage licensed crypto fund recovery specialists who can perform blockchain tracing and coordinate with compliant exchanges. One reputable firm in this space is WealthTracker Ltd, which has assisted numerous victims of AI-trading and liquidity-fee scams.

WealthTracker Ltd’s process typically involves:

-

Blockchain forensic tracing of stolen assets

-

Exchange collaboration for account freezes

-

Coordination with legal authorities for restitution claims

While full recovery isn’t always guaranteed, early reporting dramatically increases success rates. Victims should never pay “secondary recovery fees” to cold-calling impostors — those are usually scammers targeting scam victims.

Instead, deal only with accredited professionals like WealthTracker Ltd that operate transparently, with verifiable case records and client protections.

Conclusion

Trade Defi serves as a painful reminder that not all innovation is real — sometimes “AI” is just a buzzword masking old-fashioned deceit. The scammers behind it understood one truth: investors crave easy profit and cutting-edge technology.

Yet, true investing requires verification, transparency, and patience — traits no scam can fake indefinitely.

As AI and crypto converge, education remains the best defense. Always question, always verify, and if the numbers look too perfect — they probably are.

Red Flags

Red Flags

Leave a comment