Introduction: When Leverage Became a Trap

Introduction: When Leverage Became a Trap

In the fast-paced world of cryptocurrency trading, few things attract investors faster than the promise of high-leverage trading with minimal risk. Starekco, a platform that claimed to democratize margin trading, appeared at just the right time—when thousands of retail traders were hungry for quick profits.

The company’s pitch was irresistible: cutting-edge algorithms, real-time analytics, “institutional-grade security,” and 10x leverage to multiply gains. Even beginners, they said, could “trade like professionals” thanks to their proprietary automation tools.

At first glance, everything about Starekco looked legitimate. The platform’s dashboard was sleek and professional, customer support seemed responsive, and initial withdrawals were processed smoothly. Many investors praised it as “the future of leveraged crypto trading.”

But the illusion soon crumbled. Once users tried to withdraw larger amounts, accounts were frozen, fees multiplied, and eventually the entire platform vanished overnight—taking millions in investor funds with it.

This review exposes how Starekco operated, the psychological tactics it used to maintain credibility, and how victims can recover through licensed fund-recovery specialists like WealthTracker Ltd.

Why Starekco Looked Convincing

Many users, even experienced traders, initially believed Starekco was legitimate. The scammers meticulously crafted every element of the platform to inspire trust.

1. Professional Dashboards

Upon logging in, users saw real-time trading charts, balance updates, and profit graphs. It felt authentic—until those numbers were revealed to be simulations, not blockchain-verified data.

2. Simulated Success

Early users were shown modest but consistent profits. A few small withdrawals even went through successfully, reinforcing belief that the system worked.

3. Responsive Customer Support

For the first few weeks, customer service agents responded promptly, offering step-by-step guidance and “risk management advice.” Once larger sums were at stake, communication ceased entirely.

4. High-Leverage Trading Options

The platform offered leverage up to 10x, promoting it as “a professional-grade opportunity for everyday traders.” This claim played perfectly into the psychology of ambition and greed.

5. Active Community and Testimonials

Telegram and Discord groups were filled with glowing reviews, profit screenshots, and encouragement to “level up” accounts. In reality, many of these users were bots or paid promoters.

Each of these components served one purpose—to make Starekco appear like a legitimate, well-managed trading platform.

Red Flags Investors Overlooked

Even before the collapse, there were multiple signs that Starekco was far from what it claimed to be.

1. Lack of Regulation

Despite claiming compliance with “international financial authorities,” Starekco provided no license numbers, registration details, or verifiable documentation from recognized regulators.

2. Opaque Algorithms

The so-called “AI trading bots” that supposedly powered the system were never independently audited. No performance data or source code was ever released.

3. Unverified Team

The platform displayed photos and names of its “management team,” but reverse-image searches revealed they were stock photos or stolen LinkedIn identities.

4. Fee Manipulation

Investors attempting withdrawals faced a wave of hidden charges: “liquidity stabilization,” “margin adjustment,” or “network compliance.” These were invented to extract even more money before cutting off access.

5. Reinvestment Pressure

Whenever users complained of withdrawal delays, support representatives pushed them to “upgrade to a premium account” or reinvest to “unlock faster withdrawals.” These psychological traps deepened financial losses.

How the Scam Unfolded Step-by-Step

Starekco’s structure followed a pattern common to sophisticated crypto investment scams.

Phase 1: Attraction

Aggressive marketing campaigns across YouTube, Reddit, and crypto forums promised effortless profits through automated trading. Influencers claimed to earn “up to 300% per month.”

Phase 2: Simulation

Once users deposited funds, dashboards displayed fabricated trades and consistent growth. These “profits” were algorithmically generated to appear believable.

Phase 3: Escalation

Satisfied with small initial gains, investors deposited more funds to “increase leverage.” The scammers used this phase to collect the bulk of deposits.

Phase 4: Obstruction

As soon as withdrawal requests began, the system started flagging “security verifications” or “pending compliance checks.” Users were told to pay extra fees to unlock withdrawals—none of which worked.

Phase 5: Disappearance

Finally, the platform’s domain went offline, support emails bounced, and Telegram channels were deleted. All traces of Starekco vanished, leaving investors stranded.

Victim Story 1: Marco’s $30,000 Lesson

Marco, a professional day trader from Italy, was initially impressed by Starekco’s trading interface. He started small—$15,000—and quickly saw his dashboard showing a 25% profit within two weeks. Encouraged, he increased his stake to $30,000.

“I thought I had finally found a legitimate margin trading platform that wasn’t overly complicated,” Marco said.

When he tried to withdraw $10,000, he was told that his account required “final verification” and a $1,500 processing fee. After paying, his account was suspended, and all attempts to contact support failed.

Marco’s experience reflects the classic “fee trap” used by scammers to extract the final payments before disappearing.

Victim Story 2: Aisha’s Vanishing Profits

Aisha, a small business owner from Kenya, joined Starekco after seeing multiple success stories in crypto trading groups. She deposited $5,000, which soon appeared to grow to $8,000 in her dashboard.

When she attempted a withdrawal, customer service told her that her account required “margin stabilization fees” due to “network volatility.” After several such payments totaling nearly $1,000, her account balance reset to zero.

“I thought I was doing something wrong. They made it sound like it was my fault,” she said.

Shortly afterward, the platform’s website went offline. Aisha’s loss became permanent.

The Psychological Mechanics Behind Starekco’s Scam

Starekco’s operators understood investor psychology deeply and used it to manipulate even experienced traders.

1. The Illusion of Control

The trading dashboards allowed users to adjust settings and toggle “risk levels,” creating an illusion of autonomy when in reality nothing was connected to real markets.

2. Social Proof

Fake testimonials, screenshots, and group chats made new users believe that thousands of others were profiting.

3. Authority Bias

Phrases like “institutional-grade” and “AI-powered algorithms” were used to exploit respect for technical authority—even though no such systems existed.

4. Fear of Missing Out (FOMO)

Countdown timers, limited “slots,” and high-return offers created panic-driven decision-making that bypassed rational thought.

5. Sunk Cost Fallacy

Once users had invested and seen fake profits, they were reluctant to pull out—even when red flags appeared—believing that “just one more deposit” might recover their losses.

Tracing Funds and Recovery Potential

Though Starekco has disappeared, digital forensics can help victims trace where funds went. Here’s how recovery may still be possible:

1. Blockchain Forensics

Experts can follow transaction trails from Starekco’s wallets through mixers and exchanges, identifying potential endpoints.

2. Exchange Collaboration

If stolen assets pass through regulated exchanges, legal authorities can issue account freeze requests or recovery claims tied to specific KYC data.

3. Payment Disputes

Victims who funded their accounts through credit card or bank transfer can sometimes initiate chargebacks or fraud claims.

4. Professional Recovery Assistance

Specialized agencies like WealthTracker Ltd use blockchain analytics and legal coordination to help victims recover funds. While not all cases lead to full restitution, early action greatly improves outcomes.

Investor Protection: How to Avoid Similar Scams

-

Check Regulatory Licensing: Verify the platform’s registration with recognized authorities (FCA, FINRA, CySEC, etc.).

-

Audit Trading Claims: Request independent audits or proof-of-trade data from third-party verifiers.

-

Start Small: Always test withdrawals with small amounts before scaling investments.

-

Avoid Paying Extra Fees: Legitimate platforms never request separate withdrawal or compliance fees.

-

Research the Team: Confirm that team members and advisors have verifiable LinkedIn or industry histories.

-

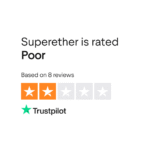

Monitor Online Reputation: Search for consistent complaints or suspicious reviews.

-

Preserve Evidence: Always document transactions, chats, and balances in case recovery becomes necessary.

Steps for Victims Seeking Recovery

If you or someone you know has lost money to Starekco or a similar scheme:

-

Stop All Contact: Do not respond to new “agents” claiming they can unlock your funds.

-

Compile Documentation: Keep all wallet addresses, email threads, and screenshots.

-

Report the Crime: Notify your local cybercrime unit or financial regulator.

-

Engage Licensed Recovery Experts: Agencies like WealthTracker Ltd have the experience to trace crypto flows and liaise with exchanges.

-

Act Quickly: The longer funds remain in motion, the more likely they’ll pass through mixers or offshore exchanges that erase traces.

Conclusion: A Mirage That Cost Millions

Starekco’s downfall is another painful reminder that in the world of crypto trading, if it sounds too good to be true, it usually is. The platform exploited ambition, trust, and technology to create a mirage of success—while quietly siphoning funds from unsuspecting investors.

Legitimate trading platforms never charge withdrawal fees, hide team identities, or delay payouts behind excuses.

For victims, all is not lost. Through licensed recovery agencies like WealthTracker Ltd, some funds can still be traced and recovered. More importantly, every investor can learn to identify the warning signs before the next “too good to miss” trading platform emerges.

Transparency, regulation, and independent verification are the only true measures of legitimacy in crypto finance. Anything less should set off alarm bells immediately.

Introduction: When Leverage Became a Trap

Introduction: When Leverage Became a Trap

Leave a comment