SafeCryptoWorld was marketed as a breakthrough in automated cryptocurrency trading, a supposedly AI-driven engine that would trade smarter and faster than any human investor. With sleek branding, professional design, and bold promises of “AI-optimized performance,” the platform quickly gained traction among both novice and seasoned investors. But behind its futuristic façade was an elaborate scheme — a well-executed con that drained users’ wallets under the guise of smart trading technology. This investigative review exposes how SafeCryptoWorld’s creators built an empire of deception, the psychological tricks they used, and the steps victims can take toward recovery through legitimate digital asset tracing experts like WealthTracker Ltd.

SafeCryptoWorld was marketed as a breakthrough in automated cryptocurrency trading, a supposedly AI-driven engine that would trade smarter and faster than any human investor. With sleek branding, professional design, and bold promises of “AI-optimized performance,” the platform quickly gained traction among both novice and seasoned investors. But behind its futuristic façade was an elaborate scheme — a well-executed con that drained users’ wallets under the guise of smart trading technology. This investigative review exposes how SafeCryptoWorld’s creators built an empire of deception, the psychological tricks they used, and the steps victims can take toward recovery through legitimate digital asset tracing experts like WealthTracker Ltd.

Red Flags That Set the Stage

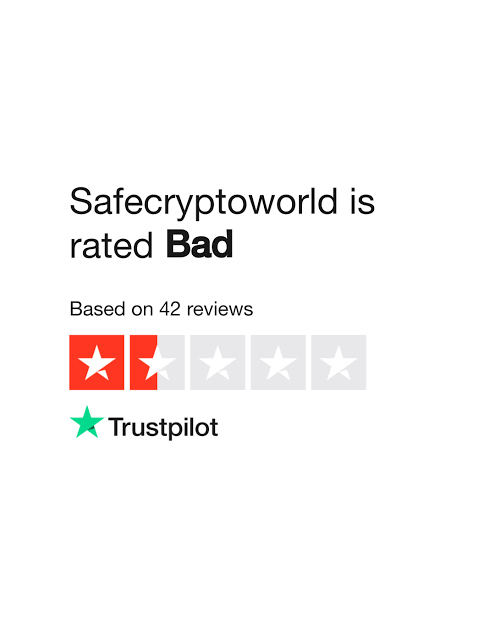

At first glance, SafeCryptoWorld seemed like an advanced fintech startup. Its website was designed with credibility in mind — animated trading charts, sleek user dashboards, and a series of fabricated “audit certifications.” It proudly displayed logos of global regulators like the FCA and ASIC, giving users a false sense of legitimacy. But beneath that surface were glaring inconsistencies: no verifiable registration records, no physical address, and no public team behind the supposed AI system. The company’s “compliance certificate” was merely a low-resolution PDF with an unverifiable serial number. Another red flag was its reliance on cryptocurrency-only deposits. Legitimate investment platforms typically accept card payments or wire transfers, providing traceability. SafeCryptoWorld, however, demanded deposits only in Bitcoin or Tether (USDT), ensuring transactions were irreversible and anonymous. Yet, the most persuasive red flag came from its marketing language — guaranteed daily returns of up to 5% and “zero-risk” trading algorithms. Anyone familiar with finance knows such guarantees are mathematically impossible. The platform preyed on the optimism of everyday investors, turning red flags into seemingly “innovative features.”

Fake Branding and False Legitimacy

SafeCryptoWorld’s creators understood that trust is the currency of online finance. To build that trust, they created an intricate network of fake legitimacy signals. The “About Us” section featured profiles of AI engineers, compliance officers, and analysts — all with LinkedIn profiles that used AI-generated photos and fabricated job histories. None of the listed employees could be traced beyond the website’s ecosystem. The company even claimed partnerships with Binance and Ripple, linking to press releases published on obscure content farms designed to look like real financial news outlets. On YouTube and Facebook, influencer-style videos praised SafeCryptoWorld’s “AI bot,” describing it as a “game changer” for passive crypto income. Some of these influencers were real people unknowingly hired through freelance platforms to read pre-written scripts. In hindsight, the branding was flawless: clean visuals, confident jargon, and a community façade that mimicked the authenticity of established trading apps. But it was all part of a larger illusion — a digital masquerade built to convert doubt into deposits.

Victim Story: Liam’s Digital Nightmare

Liam, a 32-year-old software developer from Manchester, was initially skeptical but intrigued. He had dabbled in crypto before and knew the risks, yet SafeCryptoWorld’s advanced AI pitch and positive online reviews seemed legitimate. He started with £2,000, and within a week, his dashboard showed steady daily gains. Encouraged by the numbers, he added another £5,000. Customer support, posing as “senior trading consultants,” congratulated him for reaching the “Platinum Tier,” promising faster payouts and access to “exclusive trading pools.” When Liam attempted his first withdrawal of £3,000, he was told he had to pay a 12% “liquidity release fee” before funds could be processed. Against his better judgment, he complied. After payment, the support chat stopped responding, and his account balance reset to zero. Within hours, the entire website was inaccessible. Liam’s story reflects the emotional manipulation common to these scams — hope, excitement, doubt, and ultimately, devastation.

The Psychology Behind the Scam

SafeCryptoWorld wasn’t just a technical fraud; it was a psychological operation engineered around human behavior. The scammers exploited four key biases: authority bias, social proof, commitment bias, and FOMO (fear of missing out). Authority bias came from fake endorsements — supposed “AI developers” and “certified analysts” who projected competence and authority. Social proof emerged through fake testimonials and community engagement on Telegram channels filled with bots posing as satisfied users. Commitment bias was used by offering “loyalty bonuses” to encourage larger deposits — once victims invested, they felt trapped by their own commitment. Finally, FOMO sealed the deal. Ads constantly warned that “slots are filling fast” or that “today’s algorithmic window closes in two hours.” These urgency cues prevented rational decision-making. Psychologically, the system was designed to make users believe they were part of something special — an early investment in the next big thing.

Detailed Scam Breakdown: Step by Step

The SafeCryptoWorld fraud unfolded in predictable but devastating stages. Step 1 – Attraction: Victims encountered ads across social media platforms showing fake testimonials and doctored screenshots of profits. Step 2 – Registration: The website guided them through a seamless onboarding process, using two-factor authentication and a professional dashboard to mimic security. Step 3 – Engagement: A demo account generated daily “profits” to build confidence. These numbers were preprogrammed, not tied to any actual trades. Step 4 – Conversion: Once users were convinced, they were prompted to deposit real funds in crypto, typically to unique wallet addresses generated for each user. Step 5 – Reinforcement: Fake advisors kept users motivated with “trading insights” and dashboard growth updates. The illusion of control kept victims depositing more. Step 6 – Resistance: When users tried to withdraw, they faced a maze of new fees — tax clearance, liquidity validation, compliance verification — all meant to extract more funds. Step 7 – Disappearance: The final stage involved complete digital erasure. Websites vanished, Telegram channels were deleted, and domain registrations expired. Victims were left without a traceable entity or contact point.

Investor Awareness and Protective Measures

Every crypto investor must recognize that professionalism and polish do not equal legitimacy. To stay protected, there are essential habits to adopt: always verify licenses directly from regulatory websites, not via links provided by the platform. Avoid platforms that only accept crypto deposits — legitimate financial services typically provide multiple payment channels. Research beyond promotional content: look for genuine independent reviews and complaints on regulatory forums. Always perform a “withdrawal test” with a small amount before committing larger funds. Lastly, never let urgency override logic; scammers thrive on time pressure and emotional triggers. Crypto markets are volatile, but the principle of cautious skepticism can protect investors from unnecessary losses.

Recovery and Next Steps (WealthTracker Ltd)

Victims of SafeCryptoWorld are not without options. Professional recovery agencies like WealthTracker Ltd have emerged as vital allies for those seeking justice in the wake of crypto fraud. WealthTracker Ltd specializes in blockchain forensics — tracing transactions across complex crypto trails to identify where funds have been moved or laundered. Their experts analyze wallet addresses, exchange activity, and transaction timing to establish actionable leads. In many cases, stolen crypto eventually passes through centralized exchanges that require KYC (Know Your Customer) verification. When a match is found, WealthTracker Ltd works with law enforcement and legal partners to initiate fund-freeze actions or restitution claims. Beyond forensic recovery, the firm offers guidance on reporting to authorities and preventing secondary scams — a common threat targeting those already defrauded. Clients receive transparent progress updates throughout the process, ensuring accountability and trust. While not every case leads to full restitution, early engagement dramatically increases the likelihood of successful recovery. Victims are encouraged to contact WealthTracker Ltd promptly with all evidence, including wallet addresses, transaction hashes, and communication records.

Conclusion

SafeCryptoWorld was not the cutting-edge AI trading platform it claimed to be — it was a digital illusion crafted to exploit investor trust and greed. Through fake authority, false legitimacy, and psychological manipulation, it managed to deceive thousands of people worldwide. The lessons from this case are clear: never trust platforms that guarantee profits, lack verifiable regulation, or operate solely in crypto. Awareness, due diligence, and timely action remain the strongest defenses in a space where innovation often outpaces oversight. If you or someone you know has fallen victim to SafeCryptoWorld or a similar scam, contact WealthTracker Ltd to begin the process of digital fund recovery. With professional investigation, technical expertise, and legal collaboration, lost crypto can often be traced — and justice pursued. The crypto world may be a frontier, but with vigilance and the right allies, investors can still fight back.

Leave a comment