The rise of online trading and investment platforms has opened doors for countless investors—but it has also created fertile ground for unregulated operators and outright scams. One platform drawing serious concern is HillsAssetsPro, also known as Hills Assets or hillsassetspro.com. This review digs into the company’s background, practices, and the many red flags that suggest high risk for potential users.

What HillsAssetsPro Claims

HillsAssetsPro.com markets itself as a sophisticated trading and investment portal. Its website highlights:

-

Forex, crypto, and stock trading opportunities

-

Automated trading software and high-tech analytics

-

Promises of impressive, often “low-risk” returns

-

A sleek, professional interface designed to build trust

On the surface, these claims sound appealing. The real question is whether they stand up to scrutiny.

Lack of Transparency

One of the most troubling aspects of HillsAssetsPro.com is the lack of verifiable company details:

-

Hidden Ownership – The true operators conceal their identities behind privacy-protected domain registrations.

-

No Verifiable Headquarters – Contact details are vague, with no confirmed physical office or legitimate business registration.

-

New Domain – The website was registered recently, a common pattern for short-lived schemes.

Transparency is crucial for any financial platform. HillsAssetsPro.com offers little.

No Regulatory Oversight

Legitimate brokers are licensed by recognized financial regulators (FCA, ASIC, etc.). Regulation ensures that client funds are segregated, audits are conducted, and there’s a formal process for resolving disputes.

HillsAssetsPro.com provides no evidence of any regulatory license, leaving investors without protection or recourse if funds disappear.

Reported User Experiences

Accounts from individuals who have interacted with HillsAssetsPro.com reveal a consistent pattern:

-

Attractive Promises – Ads or unsolicited contacts boast high returns and “limited time” opportunities.

-

Initial Deposit – New users are encouraged to deposit a sizable amount to begin trading.

-

Account Manager Pressure – After the first deposit, “managers” push for larger investments, claiming bigger profits await.

-

Profits Only on Screen – Users may see encouraging numbers in their accounts, but these are often just on-screen figures.

-

Withdrawal Barriers – When trying to withdraw, customers face endless delays, new “fees,” or demands for more deposits.

Classic Red Flags

| Red Flag | Why It Matters |

|---|---|

| No regulatory license | No legal safeguards or oversight |

| Hidden ownership | Operators can vanish without trace |

| Young domain age | Common in “pop-up” scams |

| High minimum deposits | Maximizes potential losses quickly |

| Withdrawal issues | Hallmark of fraudulent brokers |

| Unrealistic profit claims | Markets can’t guarantee returns |

Each of these warning signs is serious; combined, they form a clear danger signal.

Technical Observations

The site uses SSL encryption, but that only secures data transmission. Scammers often use SSL and polished web design to appear credible—this alone is no proof of legitimacy.

Likely Scam Pattern

Based on reported cases, the sequence often looks like this:

-

Aggressive Marketing – Social media ads, emails, or cold calls lure prospects.

-

Deposit & Engagement – Initial funds are deposited, and fictitious profits appear on the dashboard.

-

Upselling – Pressure to invest more escalates, often with promises of premium accounts.

-

Withdrawal Obstruction – Requests for extra fees or repeated “verification” stall or block payouts.

-

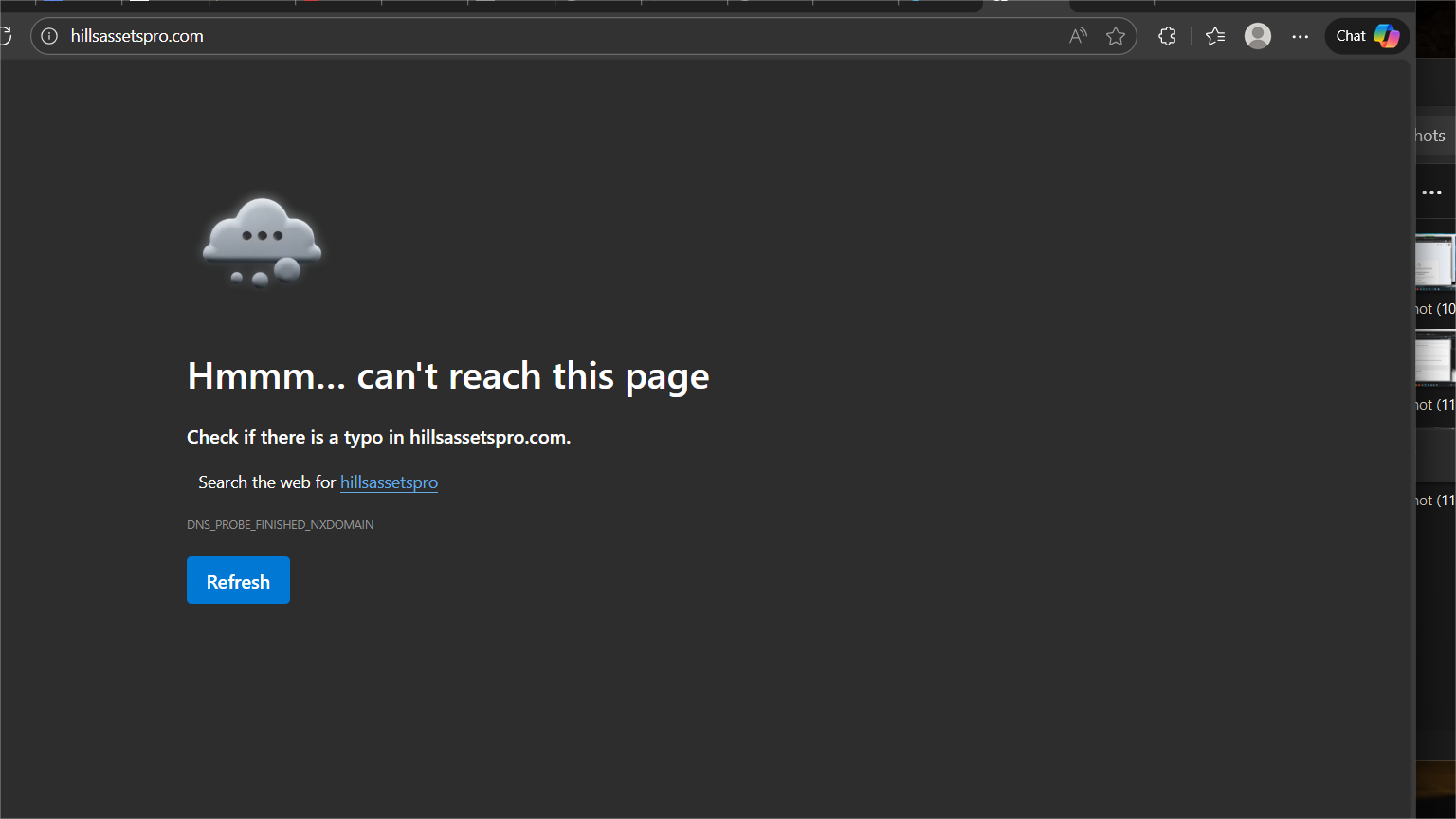

Silence or Disappearance – Support eventually stops responding; the website may even shut down.

Psychological Tactics

HillsAssetsPro.com, like many high-risk platforms, exploits common psychological triggers:

-

Authority & Professionalism – A polished website and industry jargon inspire false confidence.

-

FOMO (Fear of Missing Out) – “Limited time offers” push hasty decisions.

-

Social Proof – Glowing testimonials—often fabricated—create a sense of trust.

-

Incremental Commitment – Small initial gains tempt users into larger deposits.

Investor Risks

-

Total Loss of Funds – Deposits may be unrecoverable.

-

Identity Theft – Personal data provided for “verification” could be misused.

-

No Legal Recourse – With no regulation or clear jurisdiction, victims have few options.

Even a modest “test” deposit can quickly lead to loss.

How to Vet Any Online Broker

To protect yourself:

-

Verify Regulation – Check claimed licenses directly with official regulators.

-

Investigate Ownership – Look for verifiable business registration and leadership details.

-

Research Reputation – Seek independent reviews on established forums.

-

Test Withdrawals Early – Attempt a small withdrawal before committing larger sums.

-

Read Terms Carefully – Understand fees and withdrawal conditions.

-

Beware Pressure – Legitimate brokers do not use aggressive sales tactics.

If You’re Already Involved

If funds have been deposited, cease additional payments and document all interactions. Contact your bank or payment provider promptly to explore dispute options.

Final Assessment

HillsAssetsPro.com shows nearly every hallmark of a fraudulent or extremely high-risk trading platform: hidden ownership, lack of regulation, recent domain registration, aggressive deposit tactics, and persistent withdrawal issues. There is no credible evidence that it operates as a legitimate broker.

Conclusion

The evidence strongly suggests that HillsAssetsPro.com is unsafe for investors. Its opaque structure, unverified regulatory status, and user complaints about withdrawal failures are major red flags.

For anyone seeking online investment opportunities, the safest path is to choose a well-established, fully regulated broker with a long track record of transparent operations. As with any financial opportunity, remember: if it sounds too good to be true, it almost certainly is.

Report HillsAssetsPro.com and Recover Your Funds

If you have fallen victim to HillsAssetsPro.com and lost money, it is crucial to take immediate action. We recommend Report the scam to Trustreaders.com, a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like HillsAssetsPro.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception. Trustreaders.com, a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Leave a comment