Online trading platforms have surged in popularity, offering opportunities in forex, crypto, and other financial markets. Yet alongside reputable brokers, scam operations have proliferated—often with professional-looking websites and bold promises of quick profits. One name raising questions is Finveste.com. This in-depth review examines its background, operations, and the many red flags that point to high risk.

What Finveste.com Claims

Finveste.com advertises itself as a cutting-edge trading and investment platform. Its website highlights features such as automated trading tools, advanced analytics, and the potential for impressive returns. Prospective clients are invited to open accounts quickly, with the suggestion that profits can accumulate rapidly.

On the surface, it presents the polish of a serious financial services firm. But beneath that slick exterior, key details are missing.

Company Background: Missing Transparency

Despite its professional appearance, Finveste.com provides little verifiable information about the company running the platform:

-

Ownership Concealment – The true operators remain hidden. Domain registration details are masked, and there is no clear record of corporate officers or physical offices.

-

Limited Contact Details – The website’s contact information is sparse and does not connect to a clearly identifiable, regulated entity.

-

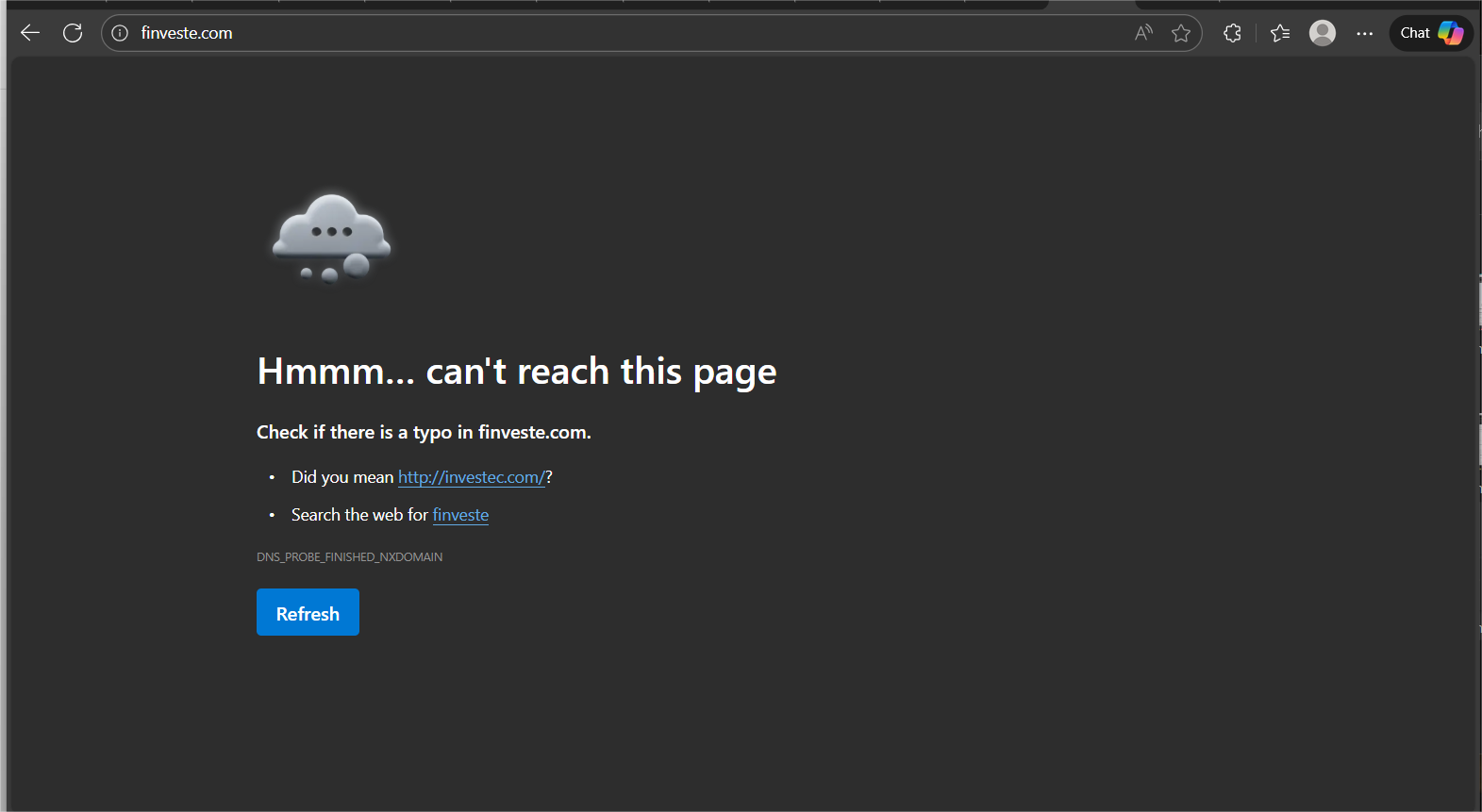

Newly Registered Domain – Records show the domain is relatively young. Scam brokers often operate briefly, collect deposits, then disappear.

For a business that claims to manage investor funds, this lack of transparency is a significant warning sign.

Absence of Financial Regulation

Legitimate brokers are regulated by recognized authorities such as the UK Financial Conduct Authority (FCA) or similar agencies worldwide. Regulation protects investors by enforcing rules on fund segregation, auditing, and dispute resolution.

Finveste.com offers no evidence of any such license or oversight. Without regulation, there is no independent body to monitor their activities or protect client funds. If disputes arise, customers have no official channel for recourse.

Typical User Experience and Complaints

Reports from individuals who have engaged with Finveste.com describe a strikingly consistent pattern:

-

Initial Attraction

Prospects are enticed by online ads or social media promotions promising outsized returns and “limited time” opportunities. -

First Deposit

New users are asked to fund an account, often with a sizeable minimum deposit. Many people start small, but the pressure to add more funds soon begins. -

Account Manager Pressure

After onboarding, users are often contacted by a so-called “account manager” who encourages additional deposits or upgrades to higher-tier accounts, promising even larger profits. -

Profits on Screen, Not in Hand

Account dashboards may display impressive gains, reinforcing trust and prompting larger investments. However, these figures often represent nothing more than numbers on a screen. -

Withdrawal Obstacles

When investors attempt to withdraw funds, they face a litany of excuses: additional fees, “taxes,” verification procedures, or unexplained delays. Some are asked to deposit more money before withdrawals can be processed—a classic scam tactic. -

Communication Breakdown

As withdrawal requests persist, customer service becomes slow, inconsistent, or entirely nonresponsive.

Key Red Flags

| Red Flag | Why It’s Alarming |

|---|---|

| No Regulatory License | Without official oversight, there’s no assurance of fair practices or fund protection. |

| Hidden Ownership | Concealed operators can vanish with client funds without accountability. |

| Young Domain Age | Recently created sites can disappear as quickly as they appear. |

| High Minimum Deposits | Requiring large upfront payments raises potential losses. |

| Withdrawal Barriers | Demanding extra payments or endlessly delaying payouts is a hallmark of fraud. |

| Unrealistic Profit Promises | Guaranteed or extraordinarily high returns defy how legitimate markets work. |

Individually these factors are concerning; combined, they strongly suggest a platform designed to extract deposits rather than enable real trading.

Technical Observations

Finveste.com uses an encrypted connection (SSL certificate), which merely secures data transfer between browser and server. While necessary for any modern site, SSL alone offers no assurance of legitimacy. Scammers frequently adopt professional web design and encryption to appear credible.

How the Alleged Scam Unfolds

-

Marketing & Outreach – Ads and unsolicited messages lure people with promises of easy money.

-

Deposit & Engagement – Clients deposit initial funds and see fabricated profits.

-

Escalation – Encouraged by early “success,” users add more funds.

-

Withdrawal Attempts – Requests to withdraw trigger endless requirements: extra deposits, fabricated taxes, or impossible documentation.

-

Loss of Funds – Eventually the platform stops responding, leaving investors without access to their money.

This sequence mirrors countless other investment frauds operating under different names.

Psychological Tactics Used

Scammers behind platforms like Finveste.com exploit human behavior:

-

Authority & Professionalism – A sleek website and jargon-laden language foster trust.

-

Fear of Missing Out (FOMO) – Limited-time offers push people to act quickly.

-

Social Proof – Glowing testimonials and fake reviews create a false sense of legitimacy.

-

Gradual Commitment – Small early profits convince users to invest larger sums.

Recognizing these tactics is key to avoiding losses.

Risks to Potential Investors

-

Financial Loss – Funds may never be retrievable once deposited.

-

Identity Theft – Personal and financial details shared during registration can be misused.

-

Lack of Legal Recourse – With no regulation or transparent ownership, recovering funds through legal means is extremely difficult.

Even a modest “test” deposit can result in loss if the broker is fraudulent.

Steps to Evaluate Any Online Broker

To avoid scams like Finveste.com, adopt these precautions:

-

Verify Regulation – Cross-check any claimed license directly on the regulator’s official website.

-

Research Ownership – Look for verifiable business registration and leadership details.

-

Read Independent Reviews – Seek feedback from neutral forums and long-standing review sites.

-

Start Small – If you proceed, deposit only what you can afford to lose and test withdrawals early.

-

Scrutinize Terms – Read the fine print on fees, withdrawals, and account requirements.

-

Beware of Pressure – Legitimate brokers don’t aggressively solicit bigger deposits.

These steps dramatically reduce the chance of falling victim to an unregulated platform.

If You’ve Already Deposited

While this blog focuses on prevention, anyone already involved should immediately stop adding funds and carefully document all communications and transactions. Acting quickly with banks or payment providers offers the best—though not guaranteed—chance to limit losses.

Conclusion

Finveste.com exhibits nearly every hallmark of a high-risk or fraudulent trading platform: hidden ownership, absence of financial regulation, young domain age, unrealistic profit claims, and persistent withdrawal issues. The evidence strongly suggests that dealing with this platform is likely to result in financial loss.

For anyone considering online investing or trading, the safest approach is to choose a well-established, fully regulated broker with transparent operations and a proven track record. No matter how convincing a website or salesperson may appear, always remember: if the promised returns sound too good to be true, they almost certainly are.

Report Finveste.com and Recover Your Funds

If you have fallen victim to Finveste.com and lost money, it is crucial to take immediate action. We recommend Report the scam to Trustreaders.com, a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Finveste.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception. Trustreaders.com, a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Leave a comment