Introduction

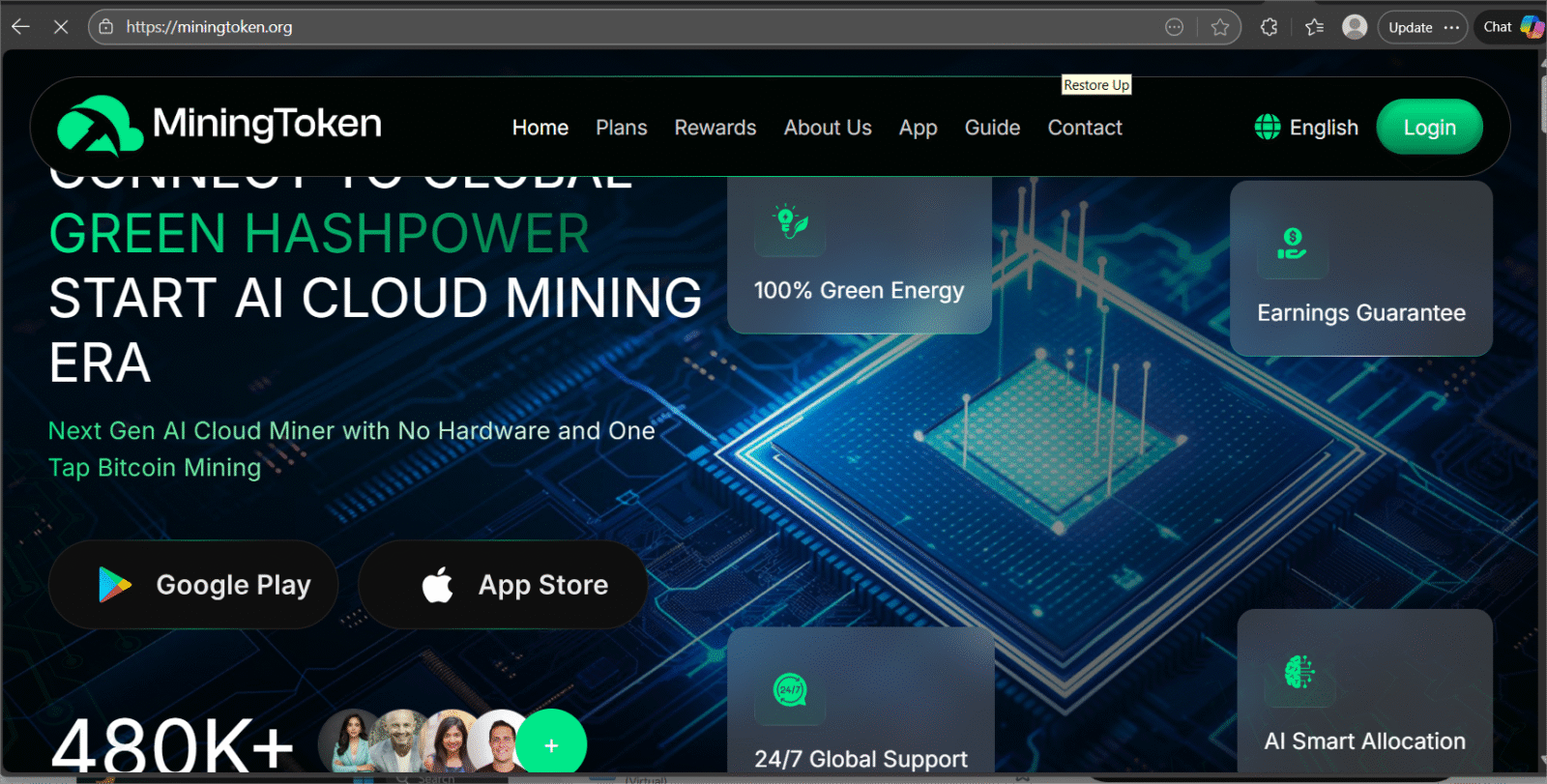

Cryptocurrency and tokenized mining offerings have become a fertile ground for innovation — and for opportunists. Companies promising passive income from “cloud mining,” tokenized mining pools, or proprietary mining hardware can be legitimate, but many are opaque, high-risk, or structured in ways that make investor losses likely. When a site markets itself under names like MiningToken, it may sound authoritative and technical. That appeal is precisely what makes scrutiny essential.

This article is a thorough, practical investigation guide: miningtoken.com / miningtoken.org, how these schemes typically operate, what specific red flags to watch for, how to run independent checks, and what to do if things go wrong.

What Sites of This Type Typically Claim

Platforms operating under names like “MiningToken” commonly make some or all of the following claims:

- Tokenized access to mining revenue (buy tokens, receive a share of mined coins).

- “Guaranteed” or high, steady returns derived from mining operations.

- Access to proprietary mining farms, optimized rigs, or proprietary mining algorithms.

- Low-cost entry and “passive” income: set it and forget it.

- Transparent dashboards showing real-time earnings and growing balances.

- Pre-sale or staking events promising priority ROI or bonuses.

- Claims of professional team, partners, or institutional backing.

Any one of these claims can be legitimate — but they also provide convenient hooks for less-scrupulous operators. The level of evidence and transparency behind the claim is the crucial test.

How These Schemes Usually Work — A Practical Breakdown

Below is a generalized lifecycle describing how tokenized mining offers operate in practice. Use this to map what you see on a target website to common patterns — and to decide whether the evidence supports the claims.

Phase 1 — Marketing and Lead Capture

Ads, social posts, YouTube videos, and seeded “reviews” drive traffic to slick landing pages. The aim: capture email/phone and register users quickly. Professional design, stock photos of miners and servers, and crypto jargon increase perceived credibility.

Phase 2 — Easy Onboarding and Low Minimum Investment

The site invites small deposits (e.g., $50–$250) to remove friction. Early signups may see small, simulated profits in dashboards to create trust.

Phase 3 — Growth Signals and Social Proof

Live tickers, testimonials, and screenshots of “payouts” appear to show legitimacy. Some platforms pay small, initial withdrawals to early users to create social proof.

Phase 4 — Upsell and Lock-In

Account managers (often via messenger apps) encourage larger deposits, token purchases, or staking plans promising better yields. Limited-time “presales” or “VIP allocations” add urgency.

Phase 5 — Withdrawal Friction or Stop

When users request bigger withdrawals, friction appears: identity documents demanded, “tax” or “processing fee” requested, or “cooling-off” periods applied. Communication slows; the platform shifts excuses.

Phase 6 — Disappearance or Rebrand

If the business is fraudulent, it may go dark, block users, or relaunch under a new name. If it’s merely undercapitalized or mismanaged, operations may still collapse without funds to pay miners or maintain infrastructure.

Concrete Red Flags to Watch For (Do Not Ignore These)

Below are the most reliable, practical warning signs. If multiple items are present, treat risk as HIGH.

1. Guaranteed or Implausible Returns

No real mining operation can guarantee fixed, high yields regardless of market and hashrate fluctuations. Any promise of steady double-digit monthly returns is mathematically suspect.

2. Anonymous Team or Fake Bios

Check every team member on LinkedIn and third-party sources. If bios are empty, photos reverse-image to generic stock images, or names have no verifiable history, that’s a major red flag.

3. No Verifiable Mine/Host Locations

Legitimate miners usually name hosting facilities, partners, or ASIC providers. If all location claims are vague or unverifiable, be skeptical.

4. Hidden Company Registration

A registered, regulated entity is the baseline. No public corporate registration, or a registration in an opaque offshore jurisdiction without meaningful disclosure, is worrying.

5. Pressure Sales and “Limited Offers”

Urgency tactics (“last 50 tokens”) are classic. Reputable issuers don’t force immediate decisions.

6. Request for Irreversible Payment Methods Only

If you’re only allowed to deposit via crypto transfers without fiat channels or card options — and no escrow or custodial proof — you lose recourse. Crypto is great, but it is irreversible and abused by bad actors.

7. Complex Withdrawal Conditions and Fees

Watch the fine print: unusually long lock-ups, “withdrawal verification fees,” or mandatory reinvestment clauses. These often explain why money stays trapped.

8. Poor or No Audited Proof of Mining Activity

Good platforms show pool addresses, on-chain receipts, mining pool accounts, or ASIC serial numbers. If none of this can be found, question the operation.

Technical and Verifiable Checks You Should Run (Step-by-Step)

Here is a practical checklist with tools you can use. Do each one before investing.

A. Domain & Hosting Checks

- Reverse IP/hosting — is the site hosted on shared IP space with many other suspicious domains?

B. SSL / Certificate and Site Security

- Confirm valid SSL (HTTPS). That’s necessary but not sufficient.

- Check if payment pages are embedded third-party gateways (good) or custom wallet addresses (risky).

C. On-Chain Evidence (If Crypto Is Used)

- Ask for the mining pool address or wallet that receives mined coins. Use blockchain explorers to confirm coin flows.

- Are token smart contracts publicly verifiable on Etherscan / BscScan? Are the token supply and minting rules transparent?

D. Corporate & Regulatory Verification

- Corporate registry search for the claimed company name in the claimed jurisdiction.

- Check for any public warnings from regulators in jurisdictions where the site claims to operate.

E. Performance Data & Audits

- Request audited financials or third-party attestation about the mining operations. Real miners can provide uptime, hashrate, and energy reports.

F. Contact & Support Tests

- Does a phone number respond? Are emails answered professionally? Test with non-sensitive questions to evaluate response quality and delays.

How to Evaluate Token Economics and Contracts

If the platform issues a “mining token,” inspect token design:

- Total supply and allocation — who holds the initial supply? Large founder allocations are high risk.

- Vesting periods — founder/treasury tokens unlocked immediately are dangerous.

- Smart contract audit — is the contract audited by reputable security firms? An audited contract does not guarantee legitimate business, but lack of audit is riskier.

- Utility vs. security — does the token function like equity (potentially a regulated security) or merely a utility? If it resembles an investment contract, it may be subject to securities law.

Realistic Scenarios: What Users Report (Generalized Patterns)

Below are anonymized, aggregated patterns reported across multiple mining/token platforms that failed users. They illustrate what can happen.

- Small initial deposits worked, bigger withdrawals blocked: Operators let early small cashouts to build trust, then blocked larger amounts.

- Account balances show “phantom earnings”: On-site dashboards show growing balances that are never actually realized on-chain.

- ID verification suddenly required at withdrawal time: Companies delay withdrawals pending KYC checks that appear engineered to extract more fees.

- Site goes offline / domain changes: After mass withdrawals, domains go dark or rebrand under a new name.

- Aggressive upsells by “account managers” on Telegram/WhatsApp: Managers push larger investments or new token offerings to maintain cashflow.

These are not universal outcomes — many projects are legitimate — but the patterns are consistent in many reported failures.

What to Do if You’ve Already Invested

If you or someone you know has invested and you suspect danger, act quickly:

- Document Everything: Download screenshots, emails, transaction receipts, chat logs. Timestamp everything.

- Try Small Withdrawals Immediately: If you can withdraw partial funds, do so. Prioritize retrieving fiat or major liquid assets.

- Contact Your Payment Provider: If you used a card or bank transfer, open a dispute promptly — timing matters.

- Report to Authorities: File complaints with your national financial authority and consumer protection bodies. Provide documentation.

- Warn Others: Post factual accounts on independent forums and consumer boards to alert potential victims.

- Consider Legal Advice: If substantial sums are involved, consult a lawyer experienced in cross-border crypto disputes.

Safer Alternatives If You Want Mining Exposure

If you are genuinely interested in mining exposure but want to avoid much of the risk:

- Invest in Established, Regulated Public Companies: Look at publicly listed miners with audited results.

- Use Reputable Cloud-Mining Providers: If using cloud mining, pick long-established companies with transparent operations and reputable reviews — but accept the business model risks.

- Buy the Actual Cryptocurrency: For pure exposure, buying BTC, ETH, or other coins directly is often simpler and more liquid.

- Consider ETFs or Funds: In some jurisdictions, funds offer exposure to miners or blockchain infrastructure in regulated wrappers.

Final Checklist: Before You Click “Buy” or “Deposit”

Ask for and verify the following:

- Who legally operates the site (company name, registration number, address)?

- Who are the named team members — are profiles verifiable?

- Where are miners physically hosted, and can this be independently verified?

- Where do revenues actually get sent (pool addresses, wallets)?

- Is there an audited performance report or third-party attestation?

- What is the exact withdrawal procedure and timeline?

- What payment methods are accepted and what recourse is available?

- Is the token smart contract publicly verifiable and audited?

If any of these answers are evasive, incomplete, or impossible to verify — walk away.

Conclusion: Be Informed, Skeptical, and Procedural

Platforms using names like miningtoken.com or miningtoken.org sit in a high-risk part of the crypto economy. Some can be legitimate experiments in tokenizing infrastructure; many are opaque, aggressive sales funnels built on marketing and urgency. The difference between a sound investment and a total loss is often a few minutes of verification.

Report miningtoken.org and Recover Your Funds

If you have fallen victim to miningtoken.org and lost money, it is crucial to take immediate action. We recommend Report the scam to WEALTH TRACKER LTD, a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like miningtoken.org persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception. WEALTH TRACKER LTD, a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Leave a comment